Introduction to Virtual Power Plants

The Energy Innovation Toolkit periodically publishes regulatory explainers for topics about which we receive a large number of enquiries to share learnings and highlight innovations happening in the industry right now.

This regulatory explainer concerns virtual power plants and how these operate under current regulations.

What is a Virtual Power Plant?

A virtual power plant (VPP) is a collection of power-generating units spread over different parts of the same energy grid, connected by a central software platform to collectively make up a larger power plant. VPPs can be made up of combined heat and power assets, renewable generation through wind and solar farms, as well as battery storage. The units are controlled (dispatched) together through the VPP, but each individual asset can operate independently.

So what does that actually mean?

Some have likened it to a computer network. On its own, one computer can only do so much, but together, 1,000 computers can achieve so much more.

Similarly, a single household solar PV and battery system can provide energy to a single household but once it is part of a network of many systems it can impact the market to a similar scale as a large battery or power plant. That’s how we get the name ‘Virtual’ power plant.

The defining feature of a VPP is the fact that the generating equipment is distributed over several (or large numbers of) locations, but the combined generated energy from this equipment is controlled and managed by a central operator – the aggregator.

Wait, what’s an aggregator?

While there is no formal definition of ‘aggregator’ in the National Energy Laws or Rules, the International Renewable Energy Agency (IRENA) considers:

"An aggregator is a grouping of agents in a power system (i.e., consumers, producers, prosumers or any mix thereof) to act as a single entity when engaging in power system markets (both wholesale and retail) or selling services to the operator."

And:

"Aggregators bundle DERs [now referred to as CERs ] to engage as a single entity – a virtual power plant (VPP) – in power or service markets."

As such, the role of an aggregator can look different in each VPP, and the point at which a VPP can be operated can be at numerous points across the electricity lifecycle.

So how do VPPs fit into the energy market?

In so many different ways.

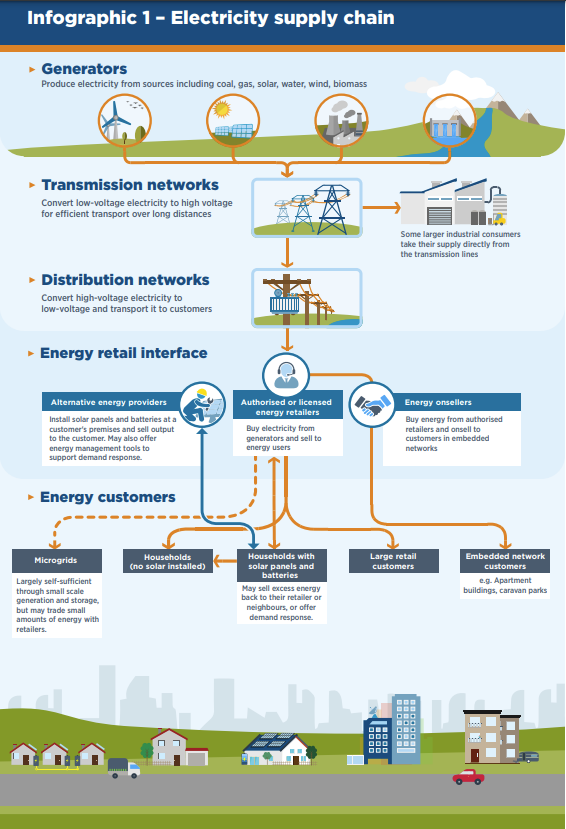

A high-level flow of the energy sector can be seen in Figure 1, below. In short, generators produce electricity (either renewable or non-renewable) which is then converted and transferred through the transmission and distribution lines to the end user.

Source: Australian Energy Regulator (AER), State of the Energy Market 2022, p.13

A VPP operator aggregates and coordinates customer distributed energy resources (CER, typically rooftop solar and batteries and also non-customer sources) using remotely controlled software to enable these distributed assets to operate collectively as a (virtual) power plant and respond to price signals in the wholesale market. VPPs can also provide frequency control ancillary services, and other network support services.

Similarly, on the generation side, an Integrated Resource Provider (IRP), in its capacity as a Small Resource Aggregator (SRA) can aggregate small generating units, which are connected to a distribution or transmission network. This registration category can allow VPPs that are not operated by retailers to access the wholesale energy market, with a few conditions. More information on these units can be found here.

Overall, aggregators can operate at a number of different points across the electricity system. Typically, aggregators utilise software or communication technologies to provide services; these are typically complex and can represent a major development cost, especially for start-ups .

So is the service offering for VPPs fixed?

Not at all! The role of VPPs is continuing to evolve.

As noted by AEMO in their VPP Knowledge Sharing Report #4 – Final Report :

"VPP offerings have diversified as the VPP market has become more established. Early VPP offerings were centred around the discounted supply of the battery and a locked-in retail deal. Later VPP offerings have become more sophisticated, offering sign-up credits and bonuses, bring your own battery options and no-lock in retailer options. VPP offerings have also diversified geographically."

A wide variety of VPP offers exist for consumers to consider, indicating this is a nascent part of the industry and no one strong business model exists (yet). These offers varied in location, reward structure and battery eligibility criteria.

There are number of different companies who are involved in VPPs and trialling different business models. AEMO has recently completed a multi-year VPP demonstration project to inform how CER can best be integrated into the energy system. Similarly for previous work they pulled together some information on the different VPP offers available at that point of time. The Solar Victoria VPP Pilot is also operating through to December 2024 and will allow for the evaluation and review of the benefits and outcomes of the program.

Various retailers, battery companies and other businesses also offer the ability to participate in a VPP, subject to meeting different eligibility requirements.

What if I want to run a VPP trial?

While there are no VPP-specific regulations you need to be aware of, there are still requirements depending on if you operate or control generation equipment (including household solar PV), if you sell to consumers, if you sell to the grid or if you want to participate in ancillary markets.

Want to see how a VPP might work in action? Check out the EIT VPP case study to see what regulatory requirements might apply.

Still have questions?

Contact us here or ask your regulatory question through our portal.